It seems like the world has agreed that gold is valuable, and we put a price on it. But how did everything become that way? Why did the ancient Egyptians and Incas worship this metal, and why do we still make the most precious objects out of it?

When humans first found this metal in its natural state, they responded to the natural beauty and rarity. It was shiny, and it represented rarity, beauty, royalty, and glamour. Since one of its properties is to be tarnish-resistant, this makes it ideal for jewelry.

The first records we have come from 40 000 BCE, in some Spanish caves. It’s a bit farfetched to presume that there were goldsmiths to work at that time in history. Recent dates such as 3600 BCE make much more sense since that’s when Egypt started to bury their pharaohs with all their riches.

Has it always been as valuable as today?

Lots of people dislike gold. They think that this metal is barbaric, and it represents the monetary systems from the past. They think that it has no intrinsic value of its own, and paper money is much better.

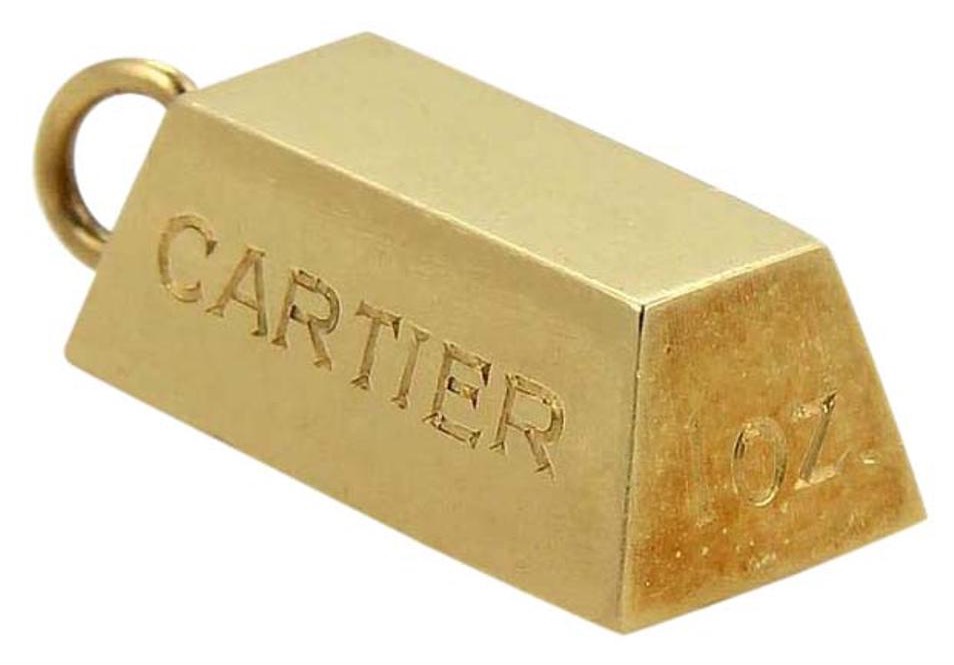

But when you think about it, most of the paper money we have today is based on this precious metal. Countries have treasuries filled with bullions. In World War II, the Nazis conquered Europe, and they stole from the treasuries of other countries. That’s how they funded the war.

The same thing happened when they were defeated. The Allies took back what was theirs. Free market trade and the entire world’s economy revolves around this shiny yellow object. Many people invest in these kinds of stocks, and that’s a great idea for times like we’re going through at the moment.

In times of crisis, such as wars, pandemics, and natural catastrophes, currencies can change. The dollar or the euro could lose their value. In times of crisis, the only thing that gets a higher selling and buying price is gold. More info here.

That’s why it’s a good idea to buy it in times of stability, and sell it in times of crisis to make a profit. Also, inflation does not affect it. If you keep a hundred dollars under your pillow, you will lose two percent of them each year. Precious metals, on the other hand, only get more expensive.

The mystery behind it

There are a few other precious metals such as silver, platinum, and palladium. The last two aren’t reactive to any other metals. However, they are extremely rare. Ancient cultures needed something that was scarce, but not impossible to find.

Not everyone could find gold, but there were still chances when you could stumble across it if you were lucky. It has some natural properties that make it pleasing to the human eye. Also, the atomic structure is particular in itself. It makes it heavy, and that also absorbs the light that gets shined on it. This creates a subtle nuance of color, and it makes it vibrantly beautiful.

How much do we have left?

Around the 1900s, the entire world mined around 400 tons per year. Now that number is close to 2500 tons. There are many reasons for that, but the main one is that there are more people. You can read this yellow gold article for more info. Since the primary purpose is jewelry, more people would mean more products.

Since the beginning of civilization, we have mined around 175 000 tons of this metal, and the number will only rise upwards. When we look at the world today, we can see that India and China are the biggest markets. India uses around 850 tons per year. China takes the second place with around 800. The third country is the United States, which spends around 150 tons per year.

Finally, we can say that gold is the logical choice when it comes to creating a medium of exchange. It has lavished properties, and it’s rare enough that not everyone can make coins out of it. It doesn’t corrode or tarnish, it’s a great electricity conductor, and it’s visually and aesthetically pleasing- not to mention it still stands as a wonderful resource to make jewelry from.

~This is a sponsored post.